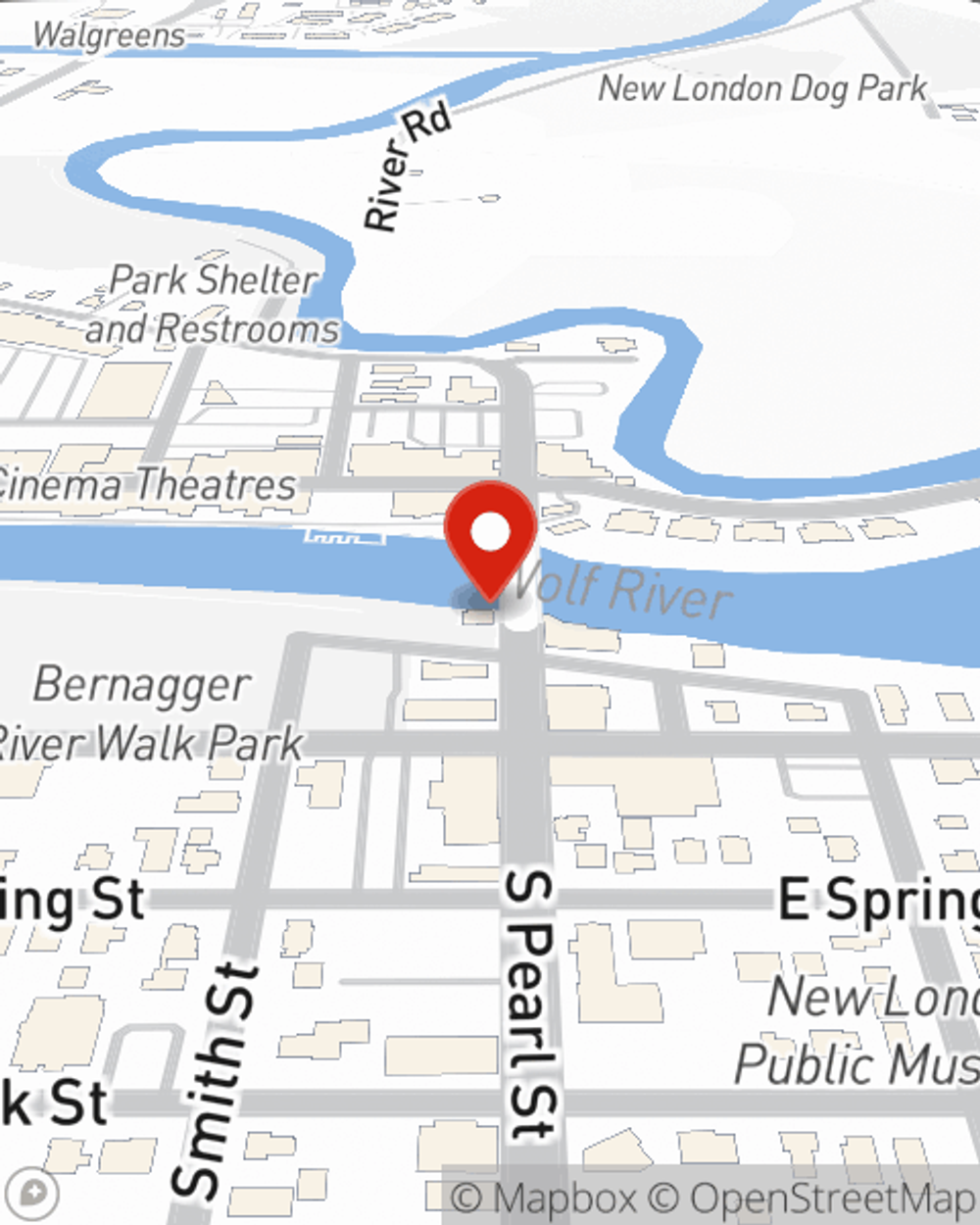

Business Insurance in and around New London

Calling all small business owners of New London!

This small business insurance is not risky

- New London

- Appleton

- Clintonville

- Hortonville

- Shiocton

- Greenville

- Menasha

- Neenah

- Kaukauna

- Weyauwega

- Fremont

- Waupaca

- Manawa

- Grand Chute

- Iola

- Seymour

- Marion

- Shawano

- Royalton

- Waupaca County

- Outagamie County

- Winnebago County

- Michigan

- Minnesota

State Farm Understands Small Businesses.

Owning a business is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, worker's compensation for your employees and extra liability coverage.

Calling all small business owners of New London!

This small business insurance is not risky

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent AJ Sics for a policy that safeguards your business. Your coverage can include everything from errors and omissions liability or business continuity plans to mobile property insurance or employment practices liability insurance.

Reach out agent AJ Sics to consider your small business coverage options today.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

AJ Sics

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.